This article was originally published by Western Investor and created in partnership with Arthur Klein of Pacific M&A and Business Brokers Ltd.

If there is one common denominator that affects a business transaction of an SME enterprise in so many ways, it is the factor of goodwill. And the expectations of both the owner (seller) and the buyer of that business will battle their test of wills around how to qualify the value of goodwill, define business transition and more.

The accepted financial or accounting definition of goodwill is the ability of a business enterprise to earn a rate of return on net assets (owner’s investment) in excess of a normal rate for the industry in which the business enterprise operates. In other words, goodwill is the difference (or premium) between the value of a business enterprise as a whole, and the sum of the current fair values of its identifiable tangible and intangible net assets.

Think of it like this: You buy a business for $1 million. The fair value of all the equipment, inventory and intangible assets, is $240,000. The remaining difference is considered to be goodwill, in this case $760,000.

Given that intangible assets represent the excess market value of a business, beyond the value of its tangible assets – goodwill (an intangible asset itself) is one that cannot be traced to an identifiable source. Nor can goodwill be separated from the company or business. Examples of typical intangible assets include patents, trademarks or contracts. So, as you can see, the rationalizing of ‘goodwill’ premium by the seller and the buyer requires careful consideration and analysis.

Since there may be a variety of reasons why this goodwill exists, it is considered to be an “unidentifiable intangible asset”. Goodwill is a capital expenditure as opposed to a current operating expense.

In business valuation, segregating the intangible value of a company between personal and enterprise goodwill is becoming increasingly relevant and is constantly tested. So let’s revisit some business valuation fundamentals.

Valuing Intangible Assets

Intangible assets often form the basis of a business’ competitive advantage. Their value can be hard to determine, but a business (owner) should always consider doing so. Unlike tangible assets (such as machinery and equipment), which often depreciate over time, the value of intangible assets (i.e. business’ brand, product formulas, employees’ skills and knowledge) often increases over time. However, accountancy rules don’t allow for such an increase in value to be included in the balance sheet. That is why it is important to seek professional advice about valuing your intangible assets.

Many intangible assets can’t be valued as they don’t meet the tests that accountants set. It may however still be important to communicate some attributes about the value of intangible assets. There are advisers, such as business valuators, available to help businesses to do this. Three main methods of valuing intangible assets are:

- Income approach – assumes that the value of an asset is the present value of future earnings from the asset.

- Market approach – based on market evidence of what third parties have paid for comparable intangible assets, – though in practice, this method is difficult to apply.

- Cost approach – based on estimating the costs of constructing or acquiring a new intangible asset that is of more or less the same use as the existing one.

Types of Business Goodwill

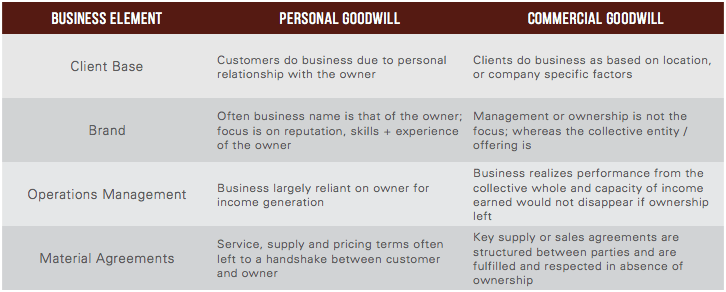

For the purposes of small and medium-sized enterprise valuation, sellers and buyers need to understand two key types of business goodwill:

- Personal

- Commercial.

For demonstration purposes, the following chart demonstrates the premium or risk associated with goodwill, and ultimately the value of the business.

De-Risking Goodwill

Going concern value indicates the existence of business assets (tangible & intangible) ready for use in producing business income or free cash-flow. The value is created because a business can effectively apply its capital (financial resources and equipment), labour (employees), and management to produce economic benefits for its owners.

In understanding the marked difference between personal and commercial goodwill, business owners (sellers) are in the position to best manage their destiny (or vanity) by undertaking measures to convert personal to commercial goodwill. And often one of the most critical mistakes or shortcomings is that business owner’s underestimate the capability of their employees. Whether due to deficiencies in staff skillset, experience or capability comes into question, owners often default to retaining control of key tasks, relationships, etc. In this context, a buyer, whether personal, strategic or financial will seek to de-risk this goodwill – often in the amount of the offer, terms of training and transition or requirement of vendor financing or earnouts.

Although owners place huge degree of loyalty on their employees, their suppliers and customers, they forget who is fundamentally taking the risk in owning the business in the first place, themselves.